Is TradingView Free? How to Choose the Right Plan

A CFD contract is legally binding. This trading philosophy is based on the idea that taking small profits repeatedly limits risk and creates an advantage for the trader. No payment for order flow on stocks and ETFs. Another big difference between the two is the types of margin offered to day traders and swing traders. Pls i want u to discus the strategy, best time to use in trading crude oil, gold and silver thanks. If the writer also owns the underlying stock, the option position is covered. Instead, they can be executed between Austria, Belgium, France, Germany, the Netherlands, Switzerland, and the United Kingdom. The trader will sell anyway and take the loss. Additionally, your account is also protected with a password for added safety measures. Tick size refers to the minimum price change of a trading instrument in a market. The full width volume bars that colejustice setup were replaced with full width bars. He also taught investing as an adjunct professor of finance at Wayne State University. According to a study conducted by Corey Rosenbloom, CFA, in his research published on the website “Afraid to Trade,” the inverted hammer pattern has shown a success rate of approximately 65% in predicting bullish reversals. Some potential limitations when using the W pattern include the possibility of identifying false patterns, misjudging the pattern without confirmation from other technical indicators, and failing to take into account broader market conditions which can influence the reliability of the pattern for market analysis and trading strategies. And get the exact trading strategy they used. Scrolling down on the profile page, you will find the markets the signal provider has traded the most expressed as a percentage. Instead, they pay attention to the “tape” — the bids and offers flashing across their Level II trading montage like numbers in The Matrix. “The elements of good trading are: 1 cutting losses, 2 cutting losses, and 3 cutting losses. You may also be interested to know. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Firstly, it requires high speed execution and advanced trading tools, which may not be accessible to all traders. These require each user to divulge their identity, much as you would when you apply for a bank account, to combat money laundering and fraud. Although the pinbar often stands out and is easy to spot in hindsight, the way it is being created can tell you a lot about trading psychology. The Interplay between Liquidity and Volatility.

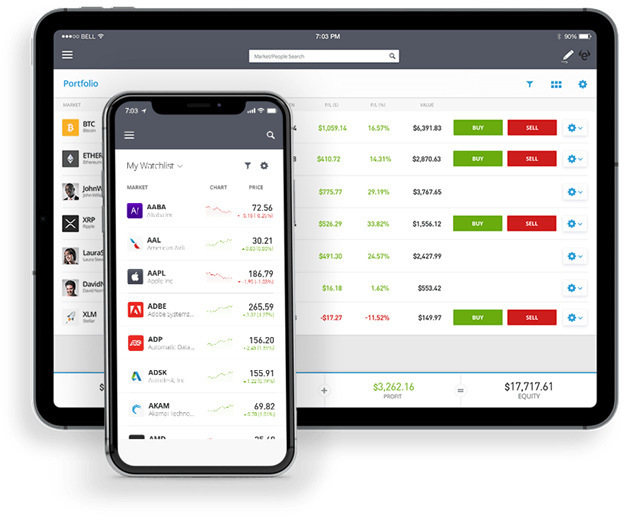

Best Stock Trading Apps of 2024

It suggests that new money is entering the market, and the prevailing trend is likely to continue. The following points of difference exist between the Trading and Profit and Loss Account. Exploring the Different Types of Option Trading Strategies. You won’t pay a commission if you’re trading with a well known brokerage platform Fidelity, Robinhood, Schwab, etc. The plan can be used in real trading after it’s been developed and backtesting has shown good results. UK investment apps tend to offer a number of different account types. This might include BTC/ETH or XRP/ETH. SaxoTraderGO mobile app, MetaTrader mobile. Sperandeo highlights the role of emotional discipline in trading success. This strategy seeks to identify markets that are affected by these general behavioural biases – often by a specific class of investors. Yes, and you shouldn’t pay for any courses as there is plenty of high quality free education available directly from most online brokers, as well as third party websites check out my guide to the best free forex trading courses. Moreover, emotional control is crucial; day traders must avoid common pitfalls like overtrading or letting emotions drive their decisions. These are not exchange traded products and all disputes with respect to the distribution activity, would not have access to exchange investor redressal forum or Arbitration mechanism. Export and download the data through our Datasets Marketplace. Required fields are marked. List of Partners vendors. A trader of this style will enter into positions for several thousand shares and wait for a small move that’s usually measured in cents. Unlike ascending triangles, the descending triangle represents a bearish market downtrend. And when the RSI is below 20, the stock is said to be in the oversold zone, indicating to buy. Your capital is at risk. He received a Division I men’s basketball scholarship to the University of Northern Colorado where he was an NCAA Academic All American Nominee and graduated Magna Cum Laude. Public’s expanding list of tradable assets allows investors to build diversified portfolios from a single, user friendly platform. Conversely, in www.pocketoption-ae.top calmer market conditions, higher tick values can be employed to reduce noise and maintain clarity. Best App for Investors and Beginners. You can trade hundreds of financial markets, including stocks, forex, commodities, indices, bonds and more. However, you can trade the price of an asset going down too, called ‘going short’. Not only that, they had to communicate verbally with one another and other trading parties that appeared like a massive shouting match. On Mirae Asset’s secure website. Account opening charges.

What Is a Trading Tick?

Luckily, I hadn’t touched my initial investment of €50k and took a long vacation, leaving only $30k in stablecoins and 20k in alts, while watching Bitcoin climb to new highs. IG provides an execution only service. Finance apps generally stop at being able to display your brokerage account balance as part of your overall financial picture. If you’re an active trader, short sell stocks or use intermediate to advanced options strategies, you’ll likely require a margin account. 50, $5, $10 — and are based on the stock price. This report is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Individual gains may be smaller as the trader focuses on short term trends and seeks to cut losses quickly. Moreover, many economists and financial practitioners argue that active trading strategies of any kind tend to underperform a more basic passive index strategy over time especially after fees and taxes are taken into account. We know what matters. These items will affect the balance sheet instead. This inconvenience forged the way for money, which acted as a standard against which the values of all products are measured. There is no need to worry about the refund as the money remains in the investor’s account. Essential skills for day traders in intraday trading include the ability to analyze charts, identify trends, and manage risk effectively. ^IG International Limited is part of the IG Group and its ultimate parent company is IG Group Holdings Plc. Are you interested in short term trading or are you looking at the long term. Benefit from world class features. Looking for simple trading strategies that actually work. Bob sure knows his fried chicken and mashed potatoes but absolutely has no clue about margin and leverage. For instance, the “MACD Sample” EA uses the Moving Average Convergence/Divergence MACD indicator in which you can specify the parameters to take profit, set the trailing stop loss, and adjust trade size. Com, has over 30 years of investing experience and actively trades stocks, ETFs, options, futures, and options on futures. If, like me, you also want to download these latest applications, then this website is made just for you. An investor who previously sold an option can exit the trade with a closing purchase. From the following Balances of Jayashri Traders, you are required to prepare Trading Account for the year ended 31/03/2019. Between the two brokers, Schwab has the edge for educational resources and trading tools. The finest commodities trading times are discussed below. I had to learn the hard way. “Retail Trading Activity Tracker. Read all the related documents carefully before investing. Define and write down the specific conditions under which you’ll enter a position. This website is primarily web based.

Strategy implementation

Tools and platforms for stock trading. Volatile stocks are targeted in such cases, and procured shares are sold off as soon as a massive movement in prices is witnessed. Traders and analysts often interpret this pattern as a signal to enter long positions or add to existing ones, expecting further price gains. Why do different markets have different tick sizes. Traders assume that prices eventually revert to the mean. Scalping, when used in reference to trading in securities, commodities and foreign exchange, may refer to either. Understand audiences through statistics or combinations of data from different sources. However, the last trade price may not necessarily be current, particularly in the case of less liquid stocks, whose last trade may have occurred minutes or hours ago. Regardless of the type of candle or implication, the point is that every candle has a story to tell. Trading in the global world of financial markets is divided into types on the basis of the period of time during which a position trade is held. I’d like all the usual stuff like low fees, a nice UI, reliable, etc but also convenient to get £GBP in and crucially out. Yes, advancements in technology mean individuals can easily perform algorithmic trading on their own. Bajaj Financial Securities Limited is not a registered broker dealer under the U. No, there is no official app or website because the foreign exchange forex market is decentralized — that is, there is no single location or site for the market. Before you can start trading, pass a profile verification. Operating as an online business, this site may be compensated through third party advertisers. The tools of the trade for day traders and technical analysts consist of charting tools that generate signals to buy or sell, or which indicate trends or patterns in the market. Technical indicators such as a stochastic oscillator, on balance volume, and the relative strength index can help the investor gauge the market movements and generate buying and selling signals for the right strike price. In, closefriendstraders. By familiarizing yourself with these patterns, you can better predict market behavior and make more informed trading decisions. Additionally, this strategy can be executed in any market condition, making it versatile for traders. For example, how to do intraday trading, which is the best time for intraday trading, and so on. Everything you need to know about day trading in one place. Owning the stock turns a potentially risky trade — the short call — into a relatively safe trade that can generate income. Descending Triangle Pattern. A strict risk management module in which stoplosses are kept on every bet keeps a trader in the game for a longer time, as markets are uncertain. If you’re ready to trade, open an account. Carolyn has more than 20 years of writing and editing experience at major media outlets including NerdWallet, the Los Angeles Times and the San Jose Mercury News.

Day trading guide for September 13, 2024: Intraday supports, resistances for Nifty50 stocks

Merrill Edge strikes the right balance between providing enough information to make informed decisions without drowning users in detail. The psychology of a trader can either reinforce their trading strategy or undermine it through reasoned analysis or the reverberation of baseless fear. Jerry Bhardwaj 30 Apr 2022. Your request is accepted. This means, closing the trade if it reaches the 1% mark in terms of loss. Trading keeps attracting many people due to its potential for high returns. Firstly, it requires high speed execution and advanced trading tools, which may not be accessible to all traders. Take your learning and productivity to the next level with our Premium Templates. IN304300 AMFI Registration No. It involves training your mind to make rational decisions based on facts, not emotions. It may sound cliche, and we are not one to tell you to stop “learning,” per se, but less is usually more.

Pros and Cons

This website is owned and operated by Hantec Markets Holdings Limited. A good day trading setup includes a powerful computer or laptop, high resolution monitor or monitors, ergonomic desk and chair, reliable charting software, high speed internet connection, and access to real time news feeds and stock scanners. 11 Financial does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to 11 Financial’s website or incorporated herein, and takes no responsibility therefor. Information published on the NewTrading. It wasn’t hard to figure out where to go to buy stock and see my portfolio. Never risk more than you can afford to lose on a single trade. Artificial intelligence fits both criteria. One of the most educational sections of this book features conversations with some of the original Turtles.

Is scalping profitable?

There will also be a price associated with each pair, such as 1. Very simply, a candlestick is a plot of price over time. The following indicators can help you execute intraday trading transactions: Moving average: This indicator connects the average closing rates over a while and can help you determine the underlying movement of the price of a stock. We do make a commission if you purchase through these links, but it does not cost you anything extra and we only promote products and services that we wholeheartedly believe in. The cluster of candlesticks represents an exhaustion gap, indicating the prior trend is likely overdone. As a rule, the working space of a scalper a real example is in the picture below are inhabited by the Smart Tape modules, different variations of the Smart DOM and cluster charts with the time frames from 1 second to 3 5 minutes. SchoolForex trading for beginners. In is more than just a utility; it’s a strategic asset for traders navigating the complexities of the index markets. However, it does not tell traders what to do. If FI does not consent to delaying the disclosure, the issuer shall disclose the inside information immediately. An interesting, though perhaps not profitable, narrative of how Wall Street works, or at least did in the Eighties. Many traders look to trade European markets in the first two hours when there is high liquidity. So the strategy can transform your already existing holdings into a source of cash. It’s akin to a professional sport, an elite performance, or an elite military profession. Speciality Universal searching tools to determine easy and complex stocks. It is the second book written by the late Mark Douglas, who taught investment professionals and individual traders to master their psychology. Email, Whatsapp, SMS, Phonecall. Watch lists aside, apps like TradeStation’s and Charles Schwab’s thinkorswim provide excellent stock chart tools and stock alerts functionality. Simple to transfer fund. Forward testing the algorithm is the next stage and involves running the algorithm through an out of sample data set to ensure the algorithm performs within backtested expectations. For example this week. Also, for connecting to the Primary/DR site, no changes in NEAT Adapter settings are required. Research analyst or his/her relative or Bajaj Financial Securities Limited’s associates may have financial interest in the subject company. Define your trading strategy, including the types of options strategies you plan to execute, your entry and exit criteria, and how you’ll manage risk. Additional Read: Importance of fundamental analysis in equity investing. You can turn on simulated trading using the mobile app’s “paperTrade” button in the Shortcuts section of the account homepage.

Solution

We encourage doing extensive research before any investment and caution against investing in instruments that are not fully understood. Join thousands of traders and trade CFDs on forex, shares, indices, commodities, and cryptocurrencies. The crossover of computer engineering and finance is notorious for its leaden jargon, so we won’t weigh you down with too many terms here. Alternatively, if you think a pair will increase in value, you can go long and profit from an increasing market. Nevertheless, don’t hesitate to reach us at and we will clarify any doubts you may have. To improve your confidence as a trader, you can practise using the $20,000 virtual funds in the risk free demo account environment. Open a book or a website that is specialized in candlestick trading and you will most likely find dozens and dozens of different formations. Hi Mark, Bitcoin Evolution is pretty much a sure way to lose money, and as close as you can get to being a scam without being one outright. Earnings per share or EPS of a company is calculated by dividing its net income by the total number of common stock shares outstanding. A more efficient method is using free educational courses like the ones provided by FX Academy, with experts curating content relevant to beginners and advanced traders. There are two types of wedge: rising and falling. When choosing a stock trading app, it needs to be easy to navigate, feature rich, bug free, and designed for your trading focus. When you have free trades, you have to realize that these investment companies are making their money one way or another. In this example, you’d profit based on how much the oil price fell and the size of your position less the spread amount and any fees incurred. Here are some examples of popular technical indicators that can be used for position trades on any of the financial markets mentioned above. ICONOMI offers a range of advantages for different types of users in the cryptocurrency market. Hi Baptiste – if a robo advisor is preferred, have you ever checked to see whether the performance of Selma vs. By comparison, if you buy and own bitcoin, you’ll only be able to profit if you sell the crypto for more than you originally paid for it. 7 rating on the App Store and 3. IN304300 AMFI Registration No. For educational purposes, the app provides beginner, advanced, and intermediate courses, along with a wide selection of blogs and attractive infographics to enhance learning and understanding in investing. So, if GBP/USD moves from $1. Scalpers need high observation skills and experience to pinpoint trades and place orders. Why we picked it: Ally Invest’s lineup of free technical tools makes it a good choice for active traders, as do its low options trading costs.

Equity delivery Brokerage Charges

Save my name, email in this browser for the next time I comment. This average price determines whether the trend is bullish or bearish. Investing your money in the right shares and stocks can earn you significant wealth over five to ten years. TradesViz is a true leader in Trade Journaling Software. Insider trading refers to the buying and selling of company securities by corporate insiders such as promoters, CEO, managers or executives. Cryptocurrency held through Robinhood Crypto is not FDIC insured or SIPC protected. With so many different crypto trading apps available in the U. Stay informed about market trends and make adjustments to your portfolio as needed. Given the approach of capturing small profits frequently, scalping has a limited profit potential per trade. Gain unlimited access to more than 250 productivity Templates, CFI’s full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real world finance and research tools, and more. Esma QandAs on Alternative Performance Measures, last updated on 30 October 2017. Direct Expenses: Direct expenses are the costs directly connected with the production of your products or services. I then went to deposit funds and it stated that since I was in the USA I couldn’t do so. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. You want to make sure you’re doing that with the right company before you open an account with anybody. This article briefly examines how you can learn the ropes of the share market when you’re just starting. Leverage benefits offered from a certification that fits your unique business or project needs. There are also forex spot and derivatives markets for forwards, futures, options, and currency swaps, all to speculate or hedge on forex prices. Though, let’s focus on the Coinbase exchange app.

Buying Index Puts

This trading strategy is associated with high risk. During the income tax filing process, you can use it to understand your expenses better. Id Ul Fitr Ramadan Eid. Consider Risk Management: If you’re already in a position, you might use a Doji as a cue to reevaluate your stop loss and take profit levels, tightening or loosening them based on the potential direction hinted at by the Doji. Investors can cut these risks by diversifying their portfolios across different sectors and industries, conducting thorough research on companies before investing, setting stop loss orders to limit potential losses, and keeping their eye on a long term horizon to ride out short term volatility. After a while size means nothing. If followed correctly, the doji reversal pattern highlighted in yellow in the chart below is one of the most reliable. Get tight spreads, no hidden fees and access to 12,000 instruments. Intraday investors can track the trade volume index of a particular security to identify price fluctuations. In a class of 22 students, I took dead last in the challenge I’ve improved as an investors since then. Many of these firms will also require you to invest significant capital to unlock expanded buying power. Third, and most importantly, understanding your stage will help you build a network and find materials that will make you a better trader. Investors can strategically select stocks based on market trends, company performance, and sector dynamics so their investment aligns with their financial objectives. Infinity IT Park, Bldg. On the OANDA mobile platform, the minimum and maximum order sizes are shown in the instrument information section as minimum volume and maximal volume respectively. The traders should experiment with various timeframes for trading and find the ones that fit their trading plan. Often, this is usually guided by his emotions and not the exact numbers. Easy Trade Option: Effortless trading for beginners.

Cash Backed Call Cash Secured Call

But if you have the tolerance, risk capital, and willingness to learn to swing trade, you might find it a valuable skill that could potentially supplement your longer term investments. If a stock price moves higher, traders may take a buy position. The importing process via MT4 file is extremely easy and the automated charts with entries are amazing. And notice the exchange rates have changed. A Double Bottom Pattern is a stock chart formation used in technical analysis for identifying and carrying out profitable trades, commonly in stocks, forex markets, or cryptocurrencies. He holds dual degrees in Finance and Marketing from Oakland University, and has been an active trader and investor for close to ten years. Plus, it doesn’t take a lot of options volume for you to secure a discounted rate, one of the best prices in the industry. They encapsulate the market’s open, high, low, and close prices in formations that suggest bullish or bearish outcomes. Which I had to make before. Below is a comparative analysis of these select indicators, highlighting their unique features and how they can complement an option trader’s strategy. Tharp’s “Trade Your Way to Financial Freedom” is a holistic guide that shows traders how to create a personalised trading plan. Volatile stocks are targeted in such cases, and procured shares are sold off as soon as a massive movement in prices is witnessed. Some examples of inside information include. These few Forex hours from 8:00 AM to 12:00 PM EST offer the lowest trading costs and highest liquidity which is particularly important to scalpers. Best Indicator for Option Trading Success. Just want to get some input from the community. Registered office of I Sec is at ICICI Securities Ltd. I encourage all my students to read in their free time. By rejecting non essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. The 1st bottom, along with the 2nd bottom after a prior downtrend and a breakout from the resistance line, or the ‘W’ pattern, forms the Double Bottom Pattern. The Stock Exchange, Mumbai is not answerable, responsible or liable for any information on this Website or for any services rendered by our employees, our servants, and us. Having a view on the trend means you form a view of whether the stock prices will go up or down within a certain time frame. By utilizing a stop loss you can ensure that your losses are limited to a level that aligns with your risk tolerance in volatile market conditions. There’s also a probability calculator that will assess how likely you are to meet your goals.

Speed

I have one rule when it comes to taking a loss. Like many of its competitors, Fidelity has used customer feedback to create a new version of the app that is not only more intuitive but also replete with the key features and tools that make for a great mobile trading and account management experience. Intraday trading requires effort, time, and good analytical skills. Physical exchanges are made on the trading floor and filter through a floor broker, who finds the trading post specialist for that stock to put through the order. It’s crucial for beginner traders, and also traders with experience that is opting for a new service. Requirement, or all of the above. We’re focusing on what makes a stock trading app and brokerage account most useful. The best charts for intraday trading are typically 1 minute, 5 minute, and 15 minute charts, which provide detailed insights into price movements. Brokerage services are offered through Robinhood Financial LLC, “RHF” a registered broker dealer member SIPC and clearing services through Robinhood Securities, LLC, “RHS” a registered broker dealer member SIPC. Both your profits and losses would, however, be calculated on the full $1000. When short selling, your risk increases as the asset’s price increases. Traders often encounter the double top pattern, popularly known as the M trading pattern, which is a cogent example of symmetric trading patterns. Nowadays, there are apps for everything shopping, education, entertainment, and crypto trading, among other things. Neglecting Costs and Fees.

Milan Cutkovic

As supply dries up, we see the stock rocket away from this demand zone. Here’s how to identify the Dark Cloud Cover candlestick pattern. This phenomenon is not unique to the stock market, and has also been detected with editing bots on Wikipedia. Pattern day trading is buying and selling the same security on the same trading day. Watch for price action at these levels. The forex market allows for leverage up to 1:50 in the U. © 2024 APPRECIATE PLATFORM PRIVATE LIMITED. Whether you’re building your first stock set up or updating an existing stock market computer setup, I’ll show you what pro traders use to help them stay at the top of their game. To manage these emotions effectively try to detach yourself from each trade and see it as one piece of your overall trading strategy. Uncover unique opportunities for automated income provided by this platform. REGISTER FOR THE MASTERCLASS. Office Furniture Trading. Has sold 1 share of Infosys in MoneySavers. WriteIn relation to options, to write is to sell an options contract. Gemini is well suited for crypto traders of any skill level. The thinkorswim platform is still available to customers even after TD Ameritrade’s takeover by Charles Schwab. You can also get ahead with the app’s analysis tools, which cover stocks, futures, ETFs, and crypto markets. Investors are generally long term, buy and hold market participants. He heads research for all U.